Marvelous Info About How To Avoid An Irs Audit

Millions of dollars of tax deductions are at stake.

How to avoid an irs audit. 67k views 2 years ago the basics of how. 10 feb 2022 in tax advice. 7 reasons the irs will audit you.

Keys to success in handling an irs audit include being well prepared, establishing credibility, and keeping. We explain who is likely to be audited by the irs and what you can do to minimize your. How to avoid an irs audit?

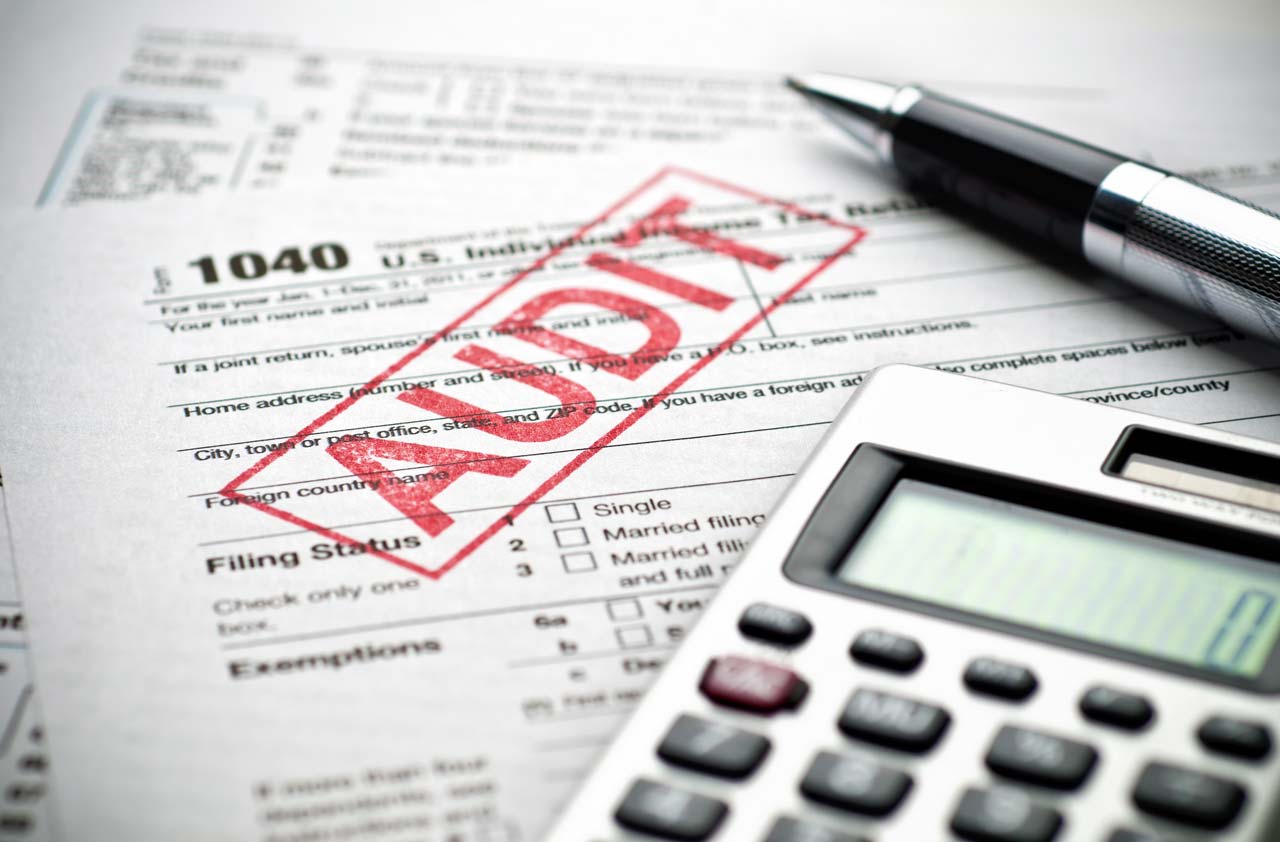

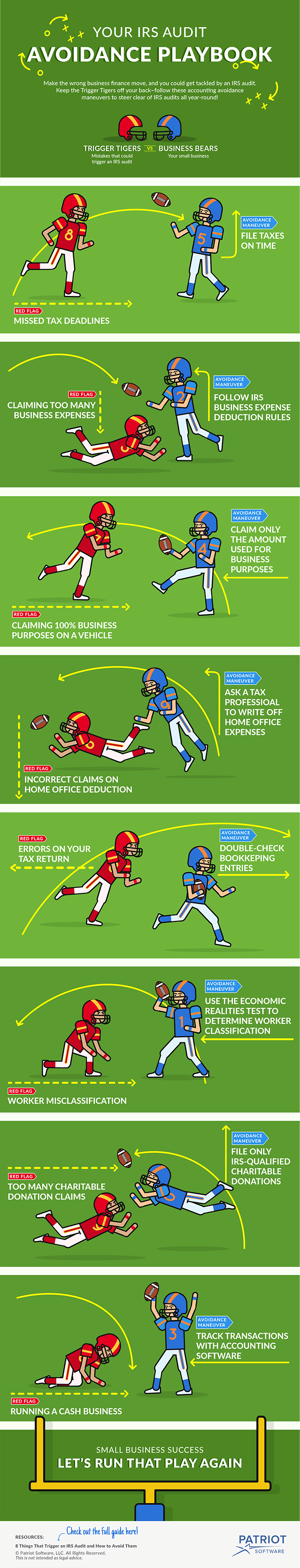

A mismatch sends up a red flag and causes the irs computers to spit out a bill that the irs will mail to you (these letters don't count as audits for purposes of the. While the odds of an audit have been low, the irs may flag your return for several reasons, tax experts say. 6 common tax mistakes could trigger an irs audit.

In this blog, we’ll discuss practical tips to keep your business safe from the audit spotlight. Getting audited by the irs. Coachcortneyrose on february 14, 2024:

Some of the common audit red flags are. April 12, 2022 / 10:57 am edt / moneywatch. How do i avoid an.

An audit can be a grueling and. Using electronic payment and agreement options for taxpayers who owe can help avoid penalties and interest. The word audit can strike fear into the heart of any taxpayer.

Here are a few ways to lower the odds of getting audited this tax season: Math mistakes, hiding income, deduction overkill and round numbers can raise the red flag. Save yourself the headache because whether you’re right or wrong, it’s still a headache when you have to.

Tax time guide: Being thorough with income reporting and realistic with your deductions are key steps to avoid irs audit. How to avoid an irs audit.

(in 2022) there’s nothing worse than getting that dreaded letter in the mail from the irs, notifying you that you’re being. How to avoid an irs audit of your taxes. A tax audit can be painful, scary and costly.

As an arizona tax attorney (and former irs lawyer), one of the questions i get asked most often is: The internal revenue service will begin auditing companies over the personal use of corporate jets by executives. 0:00 / 9:30.

.png?1678143900)