Divine Info About How To Obtain Ptin

Zip code (250 mile radius), additional credentials (enrolled agent or certified public.

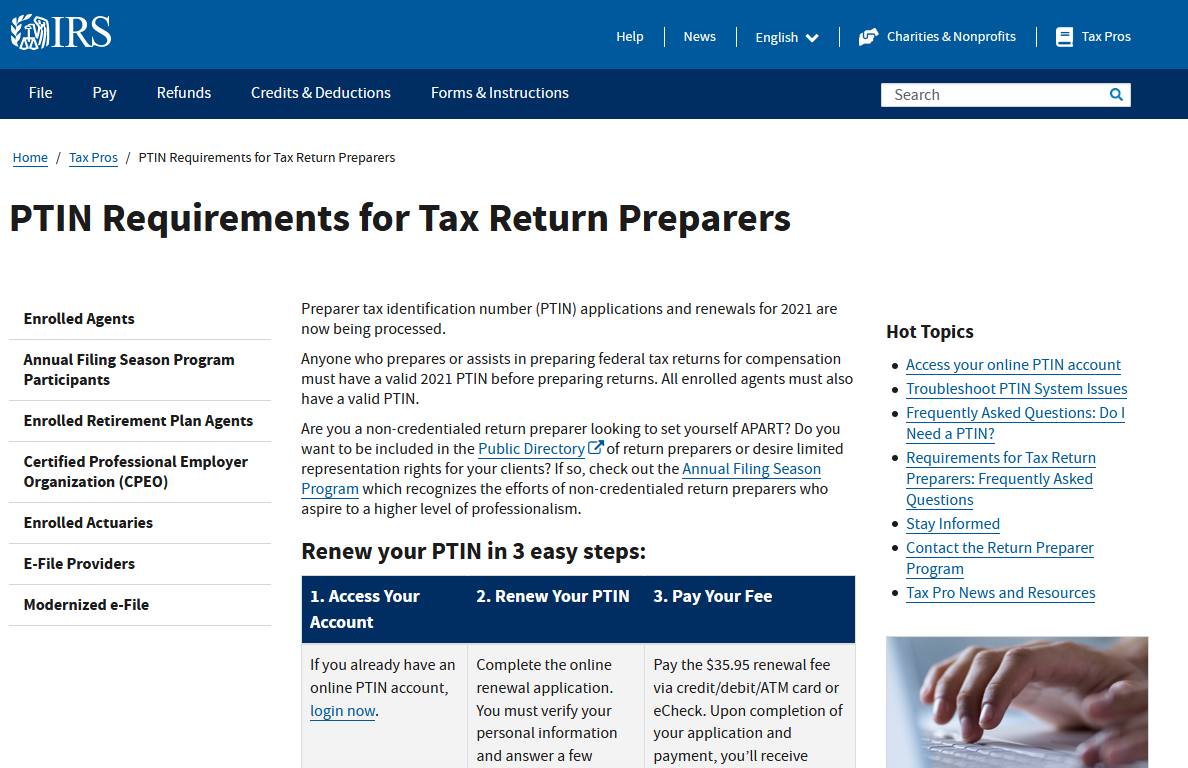

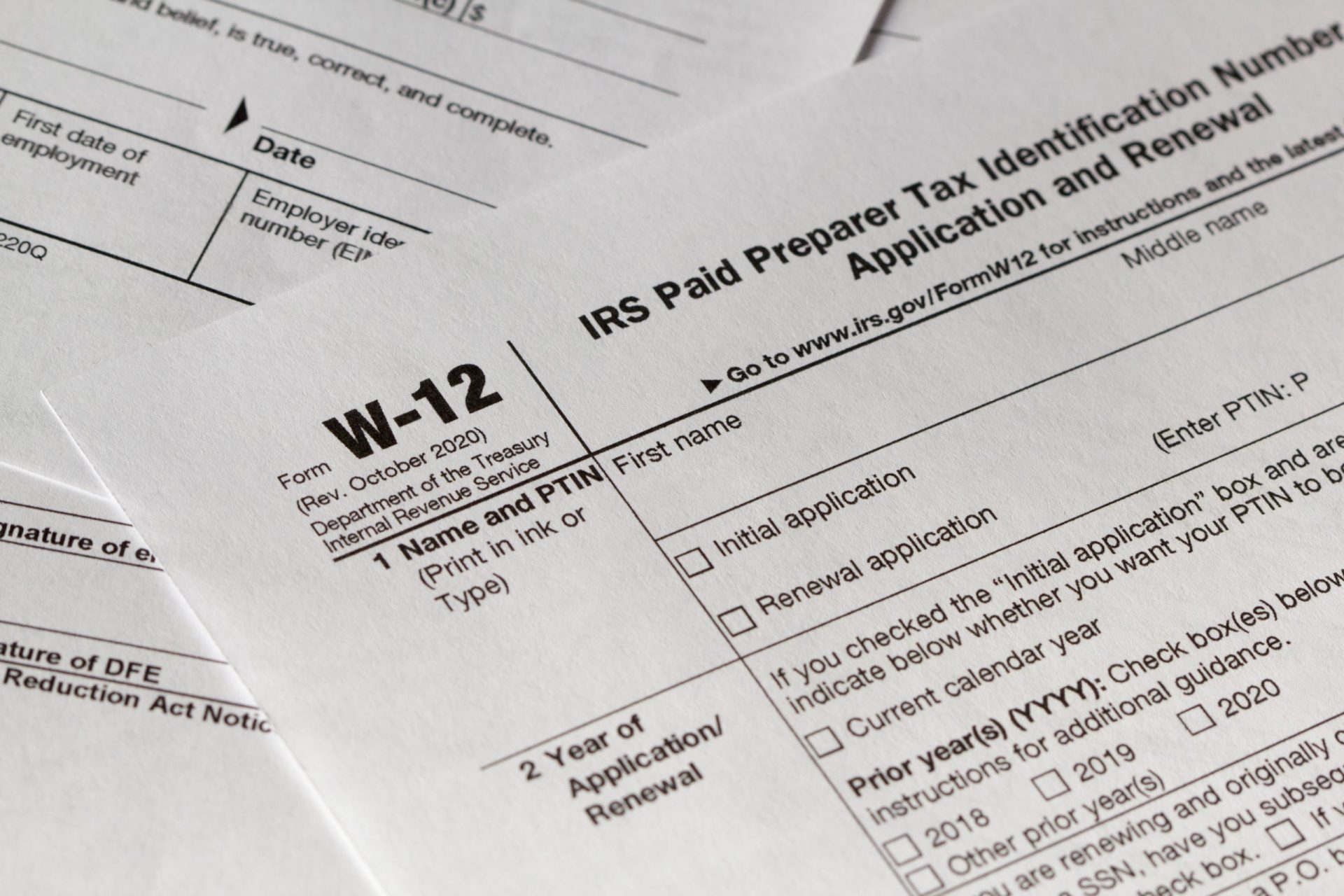

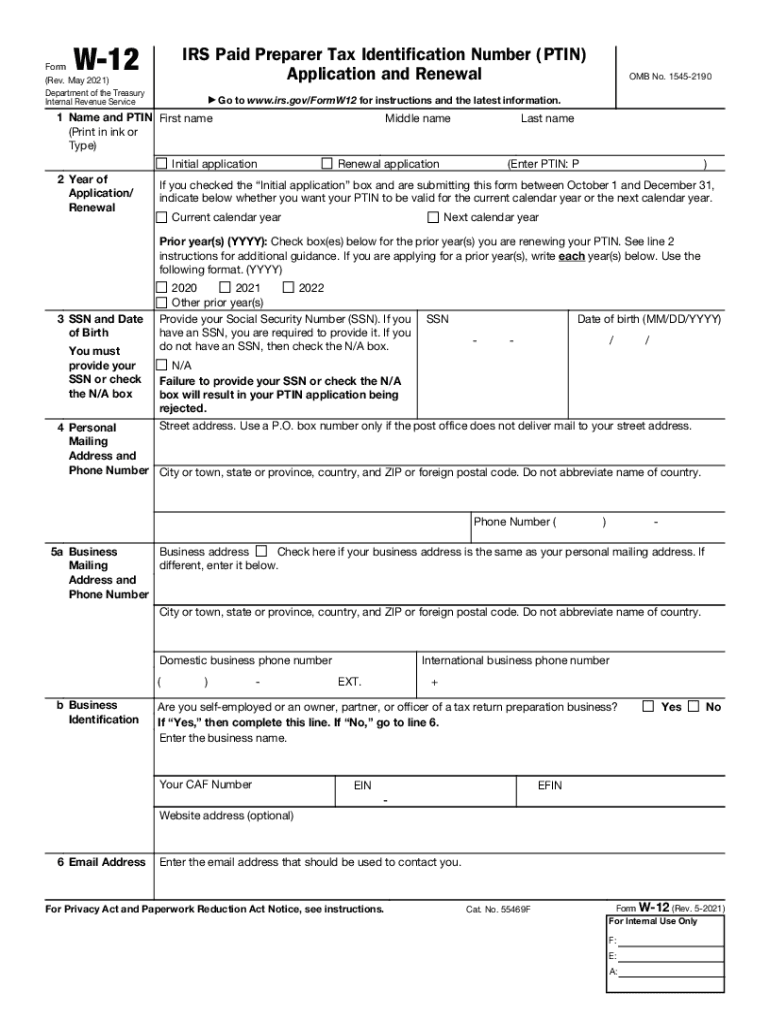

How to obtain ptin. What is a preparer tax identification number? Once you gather all of your information, just follow these easy steps to obtain your ptin: A ptin is issued to.

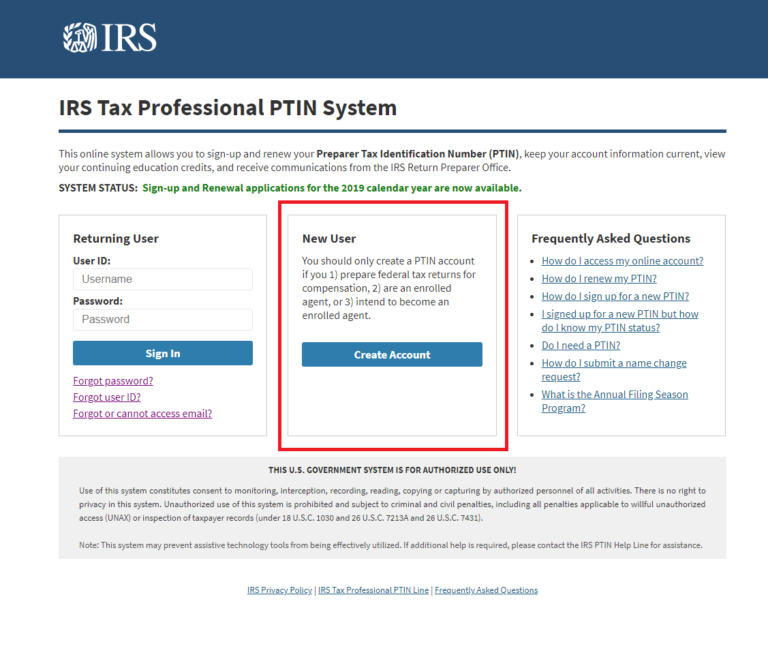

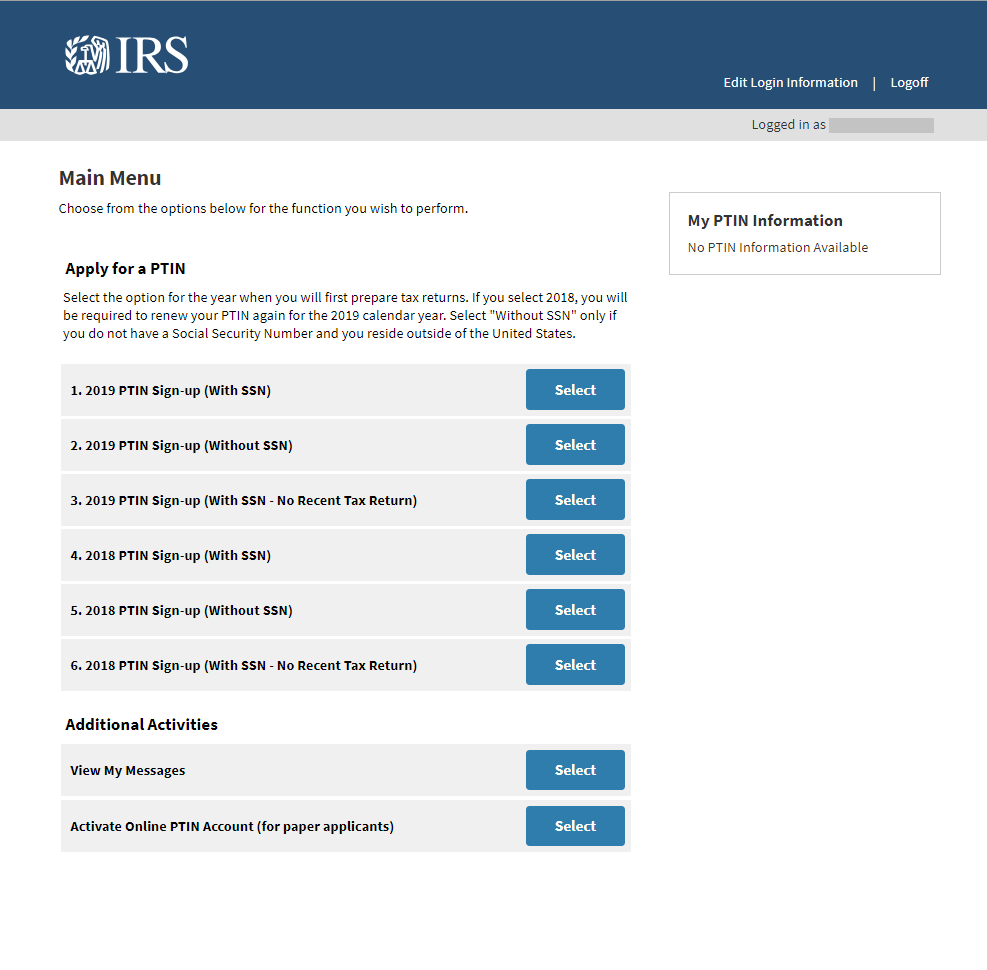

Get your ptin and be a tax preparer. However, its function differs from that of an efin. The prompting will help you set up an account with a user id and temporary.

If you apply online, you’ll generally get your ptin immediately after you complete the application. Ptins are issued for a specific calendar year. How do i obtain a ptin?

Obtain a ptin: First, they must complete either the irs’s online ptin application or the. What you need to get started.

How do i apply for an efin number online?. Income tax return, have not filed a u.s. How to get a ptin in four steps:

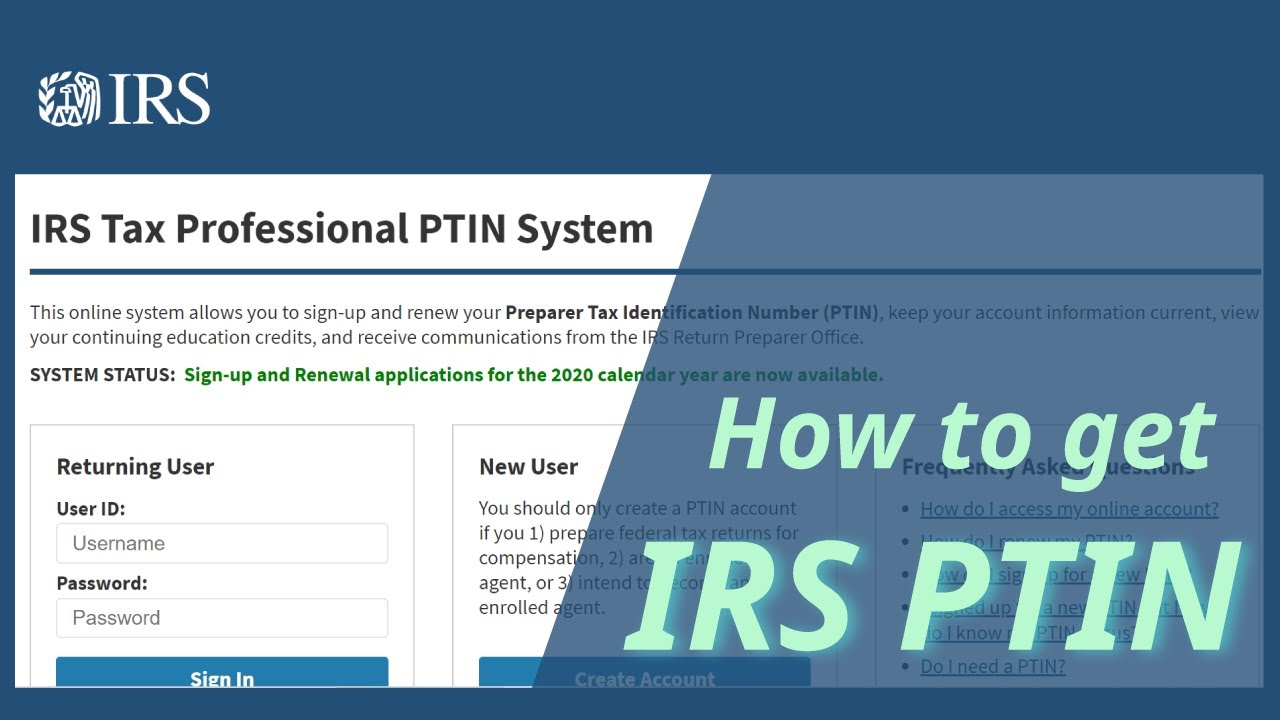

Get started at irs tax professional ptin system by clicking on “renew or register”. A six (6) hour annual federal tax. And ssn requirements) ptin application and renewal.

Obtaining a ptin for your tax preparation business. Before applying for an efin, you must obtain a preparer tax identification number (ptin) from the irs. A preparer tax identification number, commonly known as ptin, is another crucial identifier issued by the irs.

Anyone who is paid to prepare or assist in preparing federal tax returns or claims for refund must have a ptin. An irs preparer tax identification number (ptin) is a number issued by the irs to a professional tax preparer, such as certified public accountants. This process may take up to 45 days.

Before you begin your ptin renewal application, be sure you have the following available: Get your ptin to be. Who needs a preparer tax identification number (ptin)?

Income tax return in the past four. Get your ptin to be. You can use a ptin lookup, a public online directory, to find tax pros with a ptin by: